Protect Your Investment

Growth and Income

Protect Your Investment

Growth and Income

As retirees look ahead to their financial futures, prioritizing stable investment growth and establishing dependable income sources throughout retirement is crucial. In today's environment of unpredictable stock markets, escalating inflation, and complex tax issues, it is vital to adopt strategies that protect your hard-earned wealth while delivering consistent returns.

By proactively safeguarding against economic uncertainties, retirees can confidently embrace this new chapter of life, free from financial stress and equipped to enjoy their well-deserved retirement.

A New Perspective on Retirement Investing

As you move into retirement, it's crucial to confront the same challenges you faced during your working years—under protected growth and income.

Navigate the stock market's unpredictable swings with confidence.

Combat the unwavering threat of inflation.

Strategically manage the significant effects of taxes.

Retirement introduces profound transformations that deserve careful attention.

It’s crucial to view these risks through a new lens:

The danger of depleting your savings.

The possibility of compromising your quality of life.

The issue of not finishing your journey on a strong, fulfilling note.

In Retirement, Your Approach Must Transform Entirely

As you enter this new phase of life, you shift from:

A Growth Stage that emphasizes wealth accumulation to an Income Stage that prioritizes withdrawals.

Enjoying a reliable salary to taking charge of your income generation.

Following fixed schedules to the uncertainties of the future.

Viewing market fluctuations as opportunities to managing them as challenges.

The stock market's unpredictable nature and uncertainties about how long you will live can be daunting, often leading to anxiety.

The stock market's unpredictable nature and uncertainties about how long you will live can be daunting, often leading to anxiety.

But you don’t need to feel this anxious. By incorporating protected growth and income into your retirement strategy, you can safeguard against market volatility and unpredictable lifespans.

With this level of protection, you’ll be empowered to pursue your financial goals and confidently enjoy retirement.

We understand that the unpredictable stock market and concerns about longevity can create anxiety.

Like you, we recognize the overwhelming noise from the media and self-proclaimed experts.

Instead of getting caught up in the noise, we focus on a crucial element often missing from retirement strategies: a proven method for safeguarding the growth of your investments while ensuring a steady income.

Traditionally, wealth management has focused on asset accumulation, leaving retirees ill-prepared for the critical transition from their Growth Stage to their Income Stage. The outdated method of withdrawing 4% of retirement assets in the first year of retirement and adjusting for inflation is merely a withdrawal tactic; it is not an income strategy..

Neglecting to tackle the new retirement risks can lead to costly, ongoing revisions that increase stress and uncertainty.

But it doesn’t have to be that way.

By addressing these challenges and their multiple permutations, you can take proactive steps to secure a more stable retirement

We empathize with any anxiety this transition brings

Like you, we hear the noise created by the media and self-proclaimed experts.

Instead of getting caught up in the noise, we focus on a crucial element often missing from retirement strategies: an approach to protect the growth of your investments and generate income.

And it is just common sense.

Meet Mark Sherwin

Your Guide to a Protected Retirement

Mark is your dedicated guide for retirement income planning. With degrees in International Business and German from the University of Florida, Eckerd College, and the University of Freiburg in Germany, his diverse educational background provides a global perspective on retirement planning.

Over the thirty-plus years in the financial arena, Mark has held numerous certifications and licenses that enhance his ability to assist clients in retirement.

Licenses Mark Has Held:

Series 7 Securities License

Series 24 Securities Principal License

Series 65 Registered Investment Advisor

Series 214 Life Insurance License

Designations Mark Has Held:

Certified Estate Planning Practitioner (CEPP)

Certified Senior Advisor (CSA)

Certified Wealth Mentor (CWM)

As Featured In

Trusted by Industry Leaders and Featured on Renowned Platforms

At InPlay Retirement, we integrate protected growth and income into your retirement, which can alleviate anxiety and protect your lifestyle so you can embrace the future confidently.

The Stay InPlay Process

Enhancing your retirement plan with protected growth and income is essential for securing your desired lifestyle. The Stay InPlay Process aligns your retirement strategy to your lifestyle.

The Stay InPlay Process is your key to discovering strategies that resonate with your comfort level while fully supporting your unique lifestyle goals. Through this process we:

Identify Your Lifestyle Goal.

Convert Your Goals Into Practical And Acheivable Retirement Strategies.

Equip You To Make Confident, Well-Informed Decision About Your Future.

Over the past 30 years, the investment and insurance worlds have come together to craft robust solutions for your retirement. Top providers of bond and equity indices have teamed up with insurers to create innovative strategies that safeguard your investment growth and enhance your retirement income.

Picture this: enjoying the benefits of stock market growth without the anxiety of potential losses. You can secure a steady income while gaining protected growth and maximizing tax benefits.

By leveraging stock and bond indices that shield you from downturns, you transfer the risks of market fluctuations and longevity to the insurers. This empowers you to spend your hard-earned wealth with increased confidence and peace of mind.

Transform Your Retirement Experience

Protected growth and income enhances your retirement satisfaction by offering four compelling benefits:

Reduced Spending Anxiety

Protected Growth and income ease longevity risk, giving retirees the confidence that their funds will last.

Enhanced Retirement Confidence

With protected growth and income, retirees easily manage a budget, eliminating the stress of depleting savings.

Reduced Spending Anxiety

Protected Growth and income ease longevity risk, giving retirees the confidence that their funds will last.

Enhanced Retirement Confidence

With protected growth and income, retirees easily manage a budget, eliminating the stress of depleting savings.

Protect Less Financially Savvy Spouses

In many households, one spouse manages the finances. If that spouse passes away or experiences cognitive decline, guaranteed lifetime income provides security for the surviving spouse, ensuring their ongoing needs are met.

Empowered Spending

Protected growth and income allow retirees to spend more freely and enjoy life without anxiety about market ups and downs. This stability increases satisfaction, enabling even the most affluent retirees the freedom to enjoy this rewording phase of life.

Reduced Spending Anxiety

Protected Growth and income ease longevity risk, giving retirees the confidence that their funds will last.

Enhanced Retirement Confidence

With protected growth and income, retirees easily manage a budget, eliminating the stress of depleting savings.

Align Your Retirement Strategy to Your Lifestyle

Uncover Your Ideal Approach to Protect Your Lifestyle

Achieve Balance Between Your Retirement Strategy and Lifestyle

Gain Confidence and Clarity to Protect Your Lifestyle

Take Control of Your Preferences for Sourcing Your Retirement Income

Gain Clarity and Confidence Knowing Your Lifestyle is Protected

We will listen to you and discuss how to personalize your retirement income strategy

Take Control of Your Retirement Income

To safeguard your lifestyle during retirement, it’s crucial to combine protected growth and income into your strategy. This proven approach not only shields your retirement savings from market downturns but also effectively counters the impacts of inflation and taxes, giving you the confidence and peace of mind to enjoy your golden years.

In contrast, relying on unpredictable income sources brings unnecessary stress and uncertainty, jeopardizing your financial security and well-being.

Before Implementing Protected Growth and Income

Many retirees feel anxious about their spending, concerned that they may jeopardize their future lifestyle.

After Implementing Protected Your Growth and Income

You enjoy a newfound clarity and confidence in your financial future. Your income sustains your lifestyle, bringing you peace of mind and allowing you to invest more in the enriching experiences that make your retirement truly enjoyable.

By protecting your income, you will experience:

Gain a strong sense of security for your future.

Celebrate the success you’ve worked hard to achieve.

Equip yourself to make confident, informed choices for your next life phase.

Optimize Your Retirement Strategy to Secure and Boost Your Income

Incorporating protected growth and income into your retirement strategy reduces anxiety about market volatility, allowing you to pursue your passions and interests fully. Even those with substantial resources find this stability profoundly enhances their retirement experience, emphasizing its crucial importance.

Align Your Retirement Strategy to Your Lifestyle

Discover Your Ideal Approach to Protect Your Lifestyle

Achieve Balance Between Your Retirement Strategy and Lifestyle

Gain Confidence and Clarity to Protect Your Lifestyle

Take the next step towards retirement confidence and Staying InPlay

At InPlay Retirement, we align protected growth and guaranteed lifetime income strategies to your retirement lifestyle, alleviating spending anxiety so you can embrace the future confidently.

Choosing a Retirement Income Approach

As you enter retirement, your financial priorities shift from wealth accumulation to income creation, a critical transition that shapes your future. For success, you must feel comfortable and confident in your retirement approach.

Protected Growth and

Income

As retirees look ahead to their financial futures, it is crucial to prioritize stable investment growth and establish dependable income sources

Guaranteed Lifetime

Income

Integrating guaranteed lifetime income into your retirement empowers you to enjoy newfound freedom to spend your hard earned wealth confidently.

Integrating guaranteed lifetime income into your retirement empowers you to enjoy newfound freedom to spend your hard earned wealth confidently.

© 2025. Inplay Concepts Inc. ALL RIGHTS RESERVED

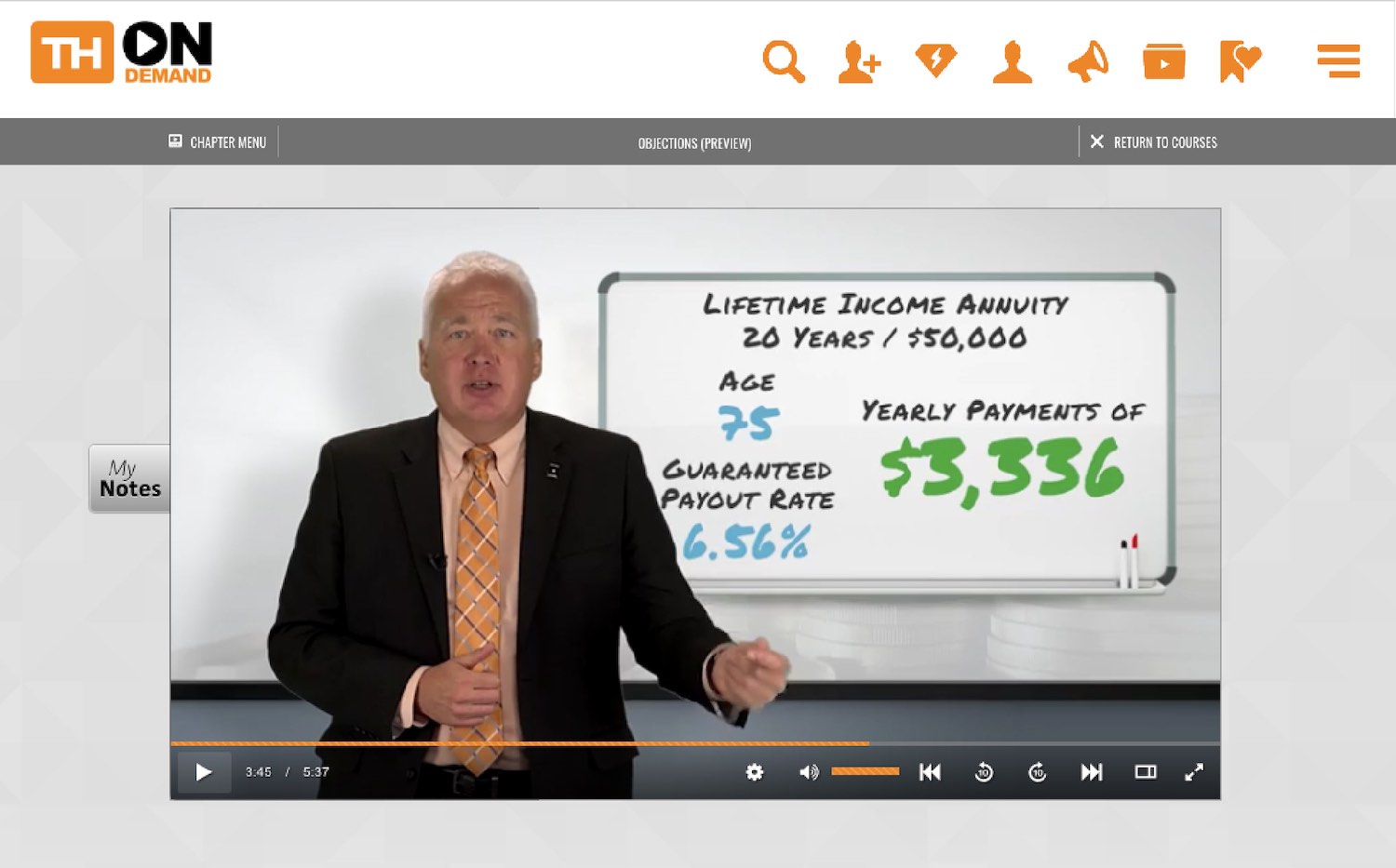

Training

Learn and practice the words, language stories and questions to communicate and sell complex financial instruments to the clients who need them the most. Real time solutions to handle every objection, close every case.

Coaching

Prepare for specific client meetings and cases with Coach Tom Hegna, and get set up every week to sell the best insurance and annuities programs for your clients so you can help them retire happy.

Education

Private member access where prospects and clients can go to understand the latest math and science for using life insurance, annuities and long term care insurance in their retirement planning to create an optimal portfolio.

Easy access at your fingertips 24/7 from any web enabled device

It's all here: Training to help you with your skills. Coaching for pre-meeting preparation. Education for your clients.

Tracking and analytics to gainImage the intelligence you need to win.

Real World.

There are optimal ways to communicate, educate, overcome objections, close, sell and write policies. These aren’t just idea’s. These skills, techniques and methods have been carefully curated from the very best and put to the test. They are based on actual real world experiences, thousands of transactions, and backed by math and science.

Tom Hegna On Demand Curriculum

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Choose your plan

MONTHLY

pay as you go

$97

ANNUAL

2 months free

$970

LIFETIME

pay once, never expires

$1997

MEMBERSHIP INCLUDES

Daily skills training and motivation

Weekly virtual pre-meeting and post-meeting coaching

Tom’s best closes and techniques for overcoming objections

Tom’s best words, questions and language for presenting annuities and life insurance products

Fast start kick off call to get you winning with the program

Provision private member access for you best prospects on Retire Happy U

Manage your private members, and use in depth analytics to gain insights

Special webinars throughout the year

Access to toll free number for assistance

Annual economic commentary

Annual updated Social Security Guide for Clients (PDF)

Retirement Alpha Guide (PDF)

Full-length "Don't Worry, Retire Happy! Seven Steps To Retirement Security" PBS Special (video)

Full-Length "Tom Hegna Talks About Guaranteed Lifetime Income" (video)

24/7 access from any web enabled device

Hegna's Hotseat monthly perspective on the financial services industry

Official Tom Hegna Certification upon successful program completion

Curriculum

See a full outline of the courses, content and topics covered inside the program.

Corporate Training

Train your entire organization with Tom Hegna On Demand. Use the live chat to request pricing and demo.

Certification

Earn Tom Hegna Certification through successfully completing over 100 interactive instructional courses and coaching.

Become a Top

Producer Today

Sign up and gain access to the training, coaching and solutions the pro's use to

build their practices'