Find your Yellow Brick Road to Financial Freedom

Find your Yellow Brick Road to Financial Freedom

Retire with Confidence

A Smarter Approach to Growing, Protecting, and Enhancing Your Wealth

Your retirement strategy should do more than just sustain you—it should give you financial security and peace of mind for life.

Capture market growth without the risk of losses

Secure a reliable income that lasts a lifetime

Protect your wealth from inflation, taxes, and market downturns

Your future deserves a plan designed for success.

Investing in Retirement Requires a New Mindset

As you enter this next stage, the landscape changes drastically. These risks can no longer be overlooked:

The Unpredictable Nature of the Stock Market

The Persistent Threat of Inflation

The Burden of Taxes

Conventional planning methods simply don’t account for the full picture. And in retirement, the stakes are higher than ever.

The Game Changes in Retirement

Without a strategy to address these challenges, you may face:

The Risk of Running Out of Money

The Risk of Losing Your Lifestyle

The Risk of Not Finishing Strong

Retirement isn’t just about making ends meet. It’s about protecting your lifestyle, ensuring your legacy, and finishing strong for the people and causes you care about most.

The Shift from Growth to Income

Everything you’ve been doing up until now gets reversed:

From Receiving a Steady Paycheck to Creating Your Own Paycheck

From Fixed Timelines to Unpredictable Horizons

From Market Volatility as a Growth Tool to Market Volatility as a Threat

Suddenly, the same tools and strategies you relied on during your working years may feel like a gamble.

Let’s Secure Your Retirement with Confidence

Your retirement isn’t just a phase—it’s your reward for decades of hard work. Together, we’ll create a strategy that ensures your income works as hard as you did, so you can embrace retirement with confidence and purpose.

In 2022, the Alliance was Elton's first and only nonprofit tour partner and the sole presenting partner of his blockbuster farewell tour across North America. That experience gave us the amazing opportunity to talk with thousands of fans at more than 65 live concerts and hear from millions of Elton followers online. Through that, one thing became abundantly clear - planning for the next chapter in life was on their minds and hugely important to them.

Much like Elton, many of his fans were closing one window but making plans to open a new one. Retirement, however you define it, was something people were excited about and looking forward to. But many were also unsure of how to prepare and how to pay for what could be many decades in retirement. They needed help in figuring that out.

That's why in 2023 we're continuing our partnership with Elton and his husband David Furnish to help you make a plan for your next chapter. And together, we're spreading the word about the importance of having enough protected income to have the financial freedom to follow your Yellow Brick Road to what's next.

Elton has long advocated for human dignity and economic equality for all. And in these volatile and uncertain economic times, where uncertainty reigns, he and David want you to know the importance of having a plan that gives you greater peace of mind and certainty. Because, as Elton says, "Secure tomorrows are something we all deserve."

We empathize with any anxiety the transition to retirement brings

Like you, we hear the noise created by the media and self-proclaimed experts.

Instead of getting caught up in the noise, we focus on a crucial element often missing

from retirement strategies: an approach that aligns your retirement income with your

retirement lifestyle.

The common approach? Withdraw 4% of your assets in your first year of retirement, adjusting for inflation afterward.

But let’s be honest

And it is just common sense.

Retirement requires more than just a plan to "get by." It demands a comprehensive income strategy to navigate the challenges ahead.

Elton John’s message on how to find the freedom to follow your Yellow Brick Road

Financial security and planning for the next phase in life are hugely important topics for Elton John. Hear more about the critical steps needed to ensure financial freedom in your life to follow your own yellow brick road to your next chapter. Want to get started today? Click below to email your financial advisor and start the protected income conversation today! so, we focus on a crucial element often missing from retirement strategies: an approach that aligns your retirement income with your retirement lifestyle.

Elton John’s message on having the financial freedom to pursue

your bucket list

The legendary, number one male recording artist of all time talks about making a plan for the future that includes protected income to cover basic expenses, so you have the freedom to pursue your bucket list.

If you have big plans for your next chapter, now is the time to meet with your financial professional to talk about your options. It starts by figuring out what you want your future to look like – your goals, needs and wants, and living with purpose. Knowing these things and having a plan in writing will help you decide how you’re going to pay for them and live the life you want. Your advisor can help you make a financial plan that includes protected income from an annuity so that you can have peace of mind knowing that your basics are covered and you can tackle that bucket list with confidence.

Following his Yellow Brick Road By Protecting His Retirement

Mike Gomez, Elton John’s head production rigger, tells us how an annuity gives him the certainty and peace of mind to pursue what’s next in life.

ON BEHALF OF THE ALLIANCE FOR LIFETIME INCOME, THANK YOU FOR JOINING US ON THE ELTON JOHN FAREWELL YELLOW BRICK ROAD TOUR!

We couldn’t have asked for a better crowd and hope you were able to make some unforgettable, bucket list–worthy memories. As you continue to check items off your bucket list, think about what other milestones you’d like to accomplish — from learning and developing new creative skills to seeing places you’ve wanted to visit.

Take the next step towards retirement confidence and Staying InPlay

At InPlay Retirement, we align protected growth and guaranteed lifetime income strategies to your retirement lifestyle, alleviating spending anxiety so you can embrace the future confidently.

Choosing a Retirement Income Approach

As you enter retirement, your financial priorities shift from wealth accumulation to income creation, a critical transition that shapes your future. For success, you must feel comfortable and confident in your retirement approach.

Protected Growth and

Income

As retirees look ahead to their financial futures, it is crucial to prioritize stable investment growth and establish dependable income sources

Guaranteed Lifetime

Income

Integrating guaranteed lifetime income into your retirement empowers you to enjoy newfound freedom to spend your hard earned wealth confidently.

Integrating guaranteed lifetime income into your retirement empowers you to enjoy newfound freedom to spend your hard earned wealth confidently.

Optimize Your Retirement Strategy to Secure and Boost Your Income

Uncover Your Preferred Sources for Generating Retirement Income

Achieve a Seamless Balance Between Your Retirement Income Strategy and Lifestyle

Gain Assurance and Clarity in Maintaining Your Quality of Life

By protecting your income, you will experience:

Renewed optimism about your future

A sense of pride in all you've achieved

Confidence in making informed and responsible choices for your next chapter

You will take control of your retirement lifestyle, ensuring it isn’t left to chance.

Optimize Your Retirement Strategy to Secure and Boost Your Income

Uncover Your Preferred Sources for Generating Retirement Income

Achieve a Seamless Balance Between Your RetirementIncome Strategy and Lifestyle

Gain Assurance and Clarity in Maintaining Your Quality ofLife

© 2025. Inplay Concepts Inc. ALL RIGHTS RESERVED

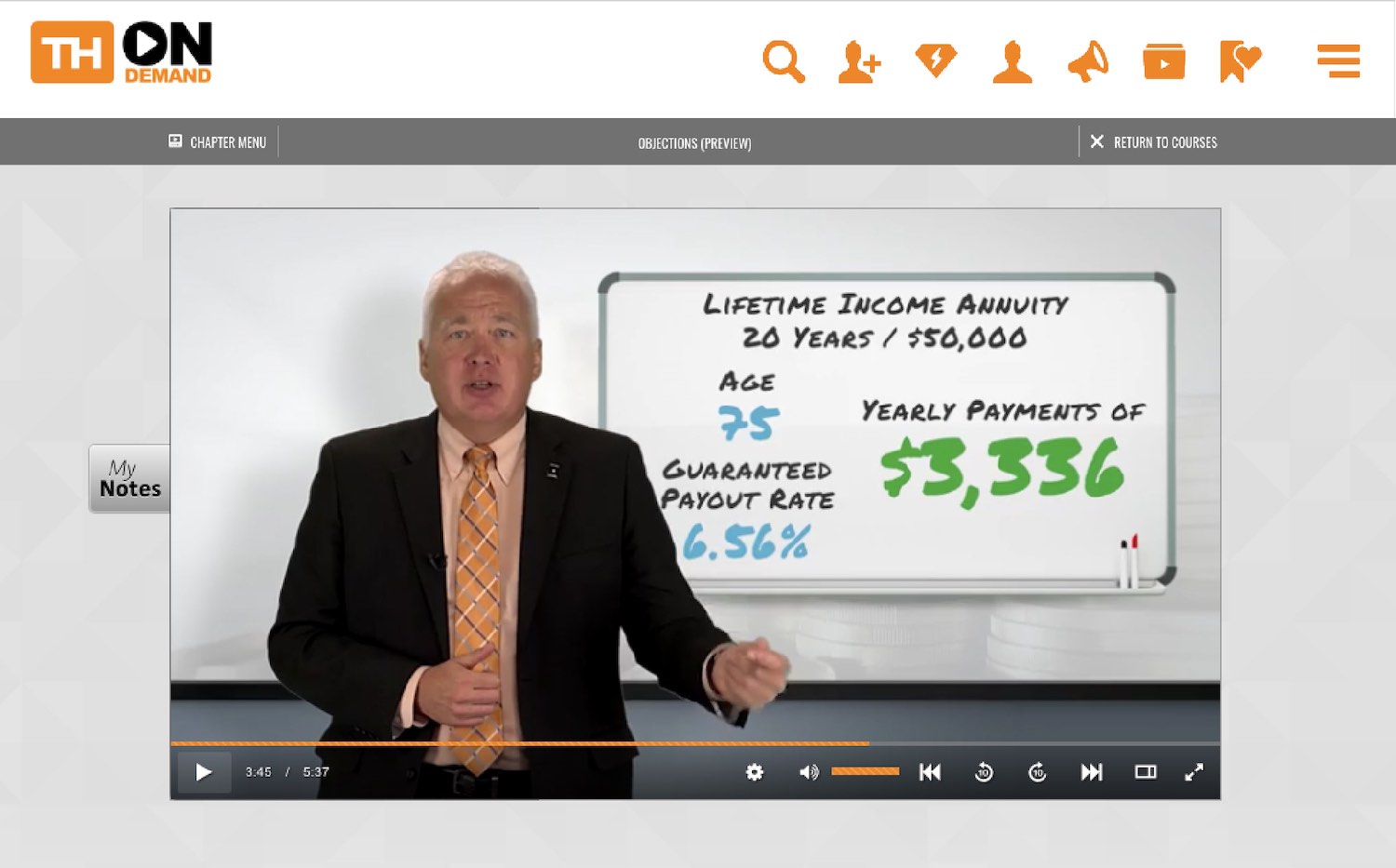

Training

Learn and practice the words, language stories and questions to communicate and sell complex financial instruments to the clients who need them the most. Real time solutions to handle every objection, close every case.

Coaching

Prepare for specific client meetings and cases with Coach Tom Hegna, and get set up every week to sell the best insurance and annuities programs for your clients so you can help them retire happy.

Education

Private member access where prospects and clients can go to understand the latest math and science for using life insurance, annuities and long term care insurance in their retirement planning to create an optimal portfolio.

Easy access at your fingertips 24/7 from any web enabled device

It's all here: Training to help you with your skills. Coaching for pre-meeting preparation. Education for your clients.

Tracking and analytics to gainImage the intelligence you need to win.

Real World.

There are optimal ways to communicate, educate, overcome objections, close, sell and write policies. These aren’t just idea’s. These skills, techniques and methods have been carefully curated from the very best and put to the test. They are based on actual real world experiences, thousands of transactions, and backed by math and science.

Tom Hegna On Demand Curriculum

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Choose your plan

MONTHLY

pay as you go

$97

ANNUAL

2 months free

$970

LIFETIME

pay once, never expires

$1997

MEMBERSHIP INCLUDES

Daily skills training and motivation

Weekly virtual pre-meeting and post-meeting coaching

Tom’s best closes and techniques for overcoming objections

Tom’s best words, questions and language for presenting annuities and life insurance products

Fast start kick off call to get you winning with the program

Provision private member access for you best prospects on Retire Happy U

Manage your private members, and use in depth analytics to gain insights

Special webinars throughout the year

Access to toll free number for assistance

Annual economic commentary

Annual updated Social Security Guide for Clients (PDF)

Retirement Alpha Guide (PDF)

Full-length "Don't Worry, Retire Happy! Seven Steps To Retirement Security" PBS Special (video)

Full-Length "Tom Hegna Talks About Guaranteed Lifetime Income" (video)

24/7 access from any web enabled device

Hegna's Hotseat monthly perspective on the financial services industry

Official Tom Hegna Certification upon successful program completion

Curriculum

See a full outline of the courses, content and topics covered inside the program.

Corporate Training

Train your entire organization with Tom Hegna On Demand. Use the live chat to request pricing and demo.

Certification

Earn Tom Hegna Certification through successfully completing over 100 interactive instructional courses and coaching.

Become a Top

Producer Today

Sign up and gain access to the training, coaching and solutions the pro's use to

build their practices'